Bitcoin was made public in 2009 started its popularity in 2010 when the cost of one bitcoin increased from fractions of a penny to $0.09. Since then, the price has increased by tens of thousands of dollars. Sometimes, it has been increasing or decreasing hundreds of dollars in just a few days. There are various reasons why Bitcoin is so volatile in its past price. Knowing the factors that affect its price in the market will help you decide if to buy it, trade it or keep track of its progress.

Reasons Behind Bitcoin’s Volatile Behavior: Why It Goes Up and Down

Following are the significant reasons for extraordinary ups and downs of Bitcoin following Analytics of Bitcoin’s behavior:

- Insufficiency of Regulation

As opposed to other asset classes which are controlled or controlled by any organization, Bitcoin is not governed or controlled by any institution. This is why crypto is distinct from fiat currencies, bonds, stocks, or stocks. The privacy aspect is what draws or dissuades investors. The laws of demand and supply decide the price of their shares.

- A Limited Supply of Bitcoin

Bitcoin is a finite digital commodity that is finite, and therefore its value will rise compared to non-finite fiat currencies in the future. The supply of Bitcoin is restricted to 21 million. However, its status as one of the most well-known cryptocurrency supply and demand dynamics play a role. To give you an example, Litecoin has a maximum supply of 84 million coins. However, Chainlink has one billion coins available.

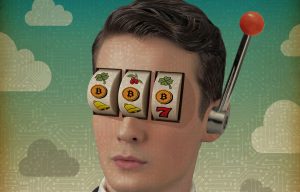

- Bitcoin Speculation

Speculation is one of the significant causes of uncertainty in the Bitcoin market. This volatility draws traders who are trying to make huge profits by predicting the movements. There is no tangible instrument to support the worth of Bitcoin or government agencies obliged to regulate its use as currency. Their value is solely based on trust.

If people lose confidence in the ability of Bitcoin to hold or increase in value, they’ll likely decide to sell. This could reduce the value and convince others also to sell. This can lead to cycles that rapidly reduces the cost. It is also possible to increase prices and cause overinflated price bubbles.

- The Bitcoin Investor Profiles

Unlike other markets like property, hurdles to access to Bitcoin the investment or trading market is not as high. For investing it, you don’t require an attorney, a trader’s license, or even a specific amount of money. Anyone with just a few dollars, with an internet connection, can start trading as soon as.

The average person who invests in the cryptocurrency market is significantly less experienced and has expertise than investors in other areas. Because of this, cryptocurrency markets are particularly vulnerable to speculation, hype and FUD (fear of uncertainty, doubt, the fear of) and unrelenting manipulation. In the cryptocurrency markets, traders often panic in situations where experienced traders can keep their cool.

Christopher is the CEO of Two Brothers Software and serves on its board of directors. Before joining Two Brothers Software, he served as chief operating officer of since October 2012, and as its chief financial officer when joining the company in May 2016.

Christopher is the CEO of Two Brothers Software and serves on its board of directors. Before joining Two Brothers Software, he served as chief operating officer of since October 2012, and as its chief financial officer when joining the company in May 2016.